The Red Hat Summit and AnsibleFest in Denver, Colorado, held on May 6-9, was an event brimming with insights, announcements, and open source discussions. This year, the insurance industry took center stage and focused on turning the excitement surrounding generative AI (gen AI) into practical, consumable technology for professionals across the insurance domain, including actuaries, underwriters, adjusters, and customer service representatives.

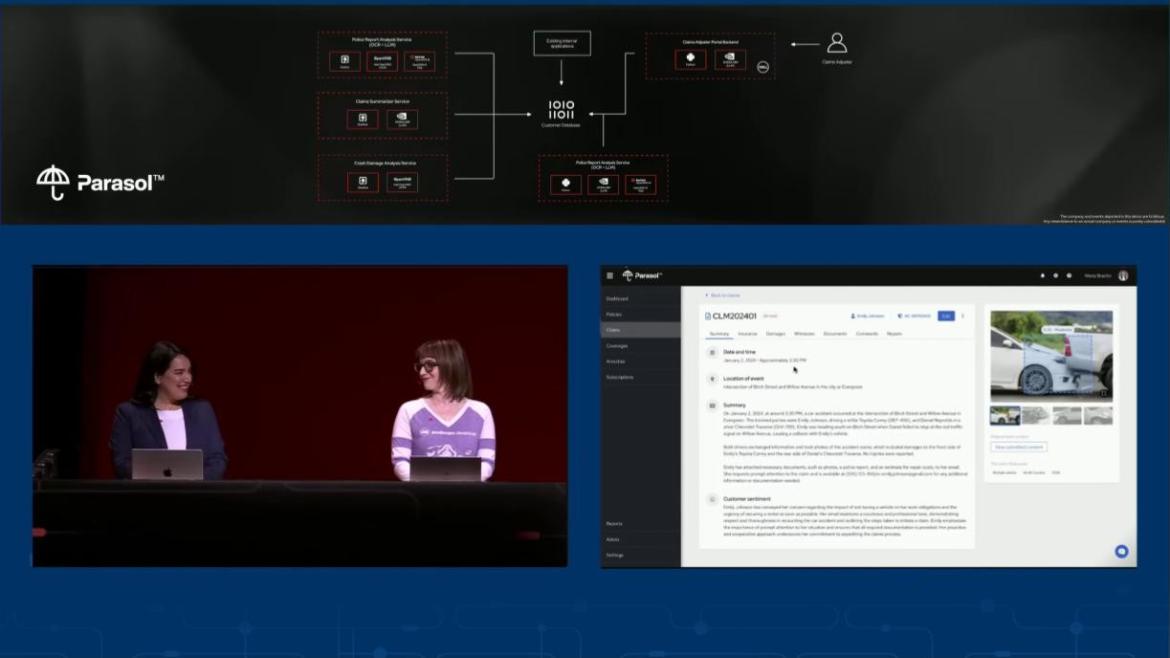

During the keynote sessions, we featured the fictional Parasol, a company representative of real world insurance scenarios, to demonstrate how historical claims data could be used to fine-tune an AI model for a Chatbot application. The example, used over two days, covers different solution areas: integrating open source with AI (the focus of this article), using AI for infrastructure remediation and anticipating problems, and enhancing operations with AI-assisted tooling.

Imagine having the ability to leverage your organization's collective domain knowledge to contribute to an AI model. By using Granite LLM and Red Hat Enterprise Linux AI (RHEL AI) on the stage, we served the model locally from a laptop, showing how to fine-tune it with insurance-specific knowledge. This hands-on involvement accelerates the development process and helps gen AI solutions to be more practical, scalable and aligned with appropriate levels of governance.

This blog guides you through the journey of transforming the data, skills, and knowledge at your disposal into a gen AI model while safeguarding your intellectual property and data.

AI in the insurance industry is a strategic necessity

Customers are frequently asking how to maximize the benefits of gen AI while taking steps to keep their intellectual property and sensitive customer data under their control. This concern is particularly severe in the insurance industry, where data privacy and compliance are paramount. Two primary concerns dominate these conversations: the fear of losing control over data once it leaves the environment and the risk of potential third-party intellectual property infringements.

The rapid evolution of the market means we are still in the early days of leveraging Large Language Models (LLM) effectively. These foundational models are built on broad, diverse datasets, but to generate true business value, they need to be specialized in the context of your sensitive data. This journey involves several techniques and patterns to deliver intelligent apps and machine learning (ML) at scale.

Kickstart your gen AI project

Many insurance companies are captivated by the excitement of AI. However, they struggle to find the right approach for integrating it into their business. The most powerful AI use cases lie in the long term, so how you build that AI platform today can be decisive in achieving an ROI or failure in 3 to 5 years later. While chatbots have been used in the insurance industry for years, the goal now is to explore more profound applications of gen AI that can transform core operations.

The path to integrating AI begins with overcoming initial fascination and moving towards strategic implementation. Whether it involves training models from scratch, fine-tuning foundational models, or using hosted APIs, the process can seem daunting. Developers new to AI might find it challenging to stitch together the various systems, tools, and design patterns used in a gen AI app stack.

A recent survey by Deloitte revealed that 79% of insurance executives believe GenAI will change their businesses within three years. However, 52% of insurance companies are not currently using AI or ML and have plans to explore these technologies, according to the NAIC Life Insurance AI/ML Survey Results 2023. This gap underscores the need for a structured approach to AI adoption, focusing on scalability, integration, and practical application to bridge the divide between excitement and execution. |

To facilitate this journey, Red Hat has made it possible for developers to get up to speed quickly and confidently. By using tools like Podman Desktop and the AI Lab extension, developers can build and test container-based applications locally before deploying them on a larger scale. This approach minimizes complexity and costs while maximizing productivity and confidence.

Enabling AI models for developers

Developers play a crucial role in transformational projects, not uncommonly leading the charge in the art of possible to drive digitalization forward. Once a development environment is set up, the next step is to safeguard data privacy and intellectual property. It is limiting to view AI merely as a hosted service behind an API call. For insurers, anything beyond their control represents a risk.

At Red Hat Summit 2024, we showcased how to empower developers with LLM foundational models at their fingertips, transforming their local systems into AI playgrounds. This approach ensures no additional costs and no risk of exposing sensitive data.

Showcasing AI in insurance

Parasol exemplified how insurance companies can infuse existing applications with AI to enhance operational efficiency and customer experience. Starting with a proof of concept on a laptop, the journey progressed from small-scale hardware for additional fine-tuning to full production with MLOps. This scenario included a Claims application—a core system made up of multiple models, frameworks, services, and infrastructures.

In this context, Parasol's journey highlighted the importance of optimizing operational processes and assessing risks. By leveraging AI, Parasol transformed a typical Claims application into an intelligent system capable of delivering significant value.

From AI playgrounds to production

The Parasol demo not only showcased the initial stages of AI integration but also highlighted the transition from development to full-scale production. One of the key components enabling this journey is Red Hat OpenShift AI, which provides a robust and scalable platform for deploying AI applications at an enterprise level.

Red Hat OpenShift offers a comprehensive suite of tools and services designed to support the entire lifecycle of traditional and AI application development and deployment. By using OpenShift, insurance companies can move beyond experimentation and into production with confidence, knowing that their AI applications are running on a secure, scalable, and reliable platform.

Key Takeaways

- Start small, experiment locally, and build confidence before scaling up

- Use tools that facilitate local development and ensure data privacy and intellectual property protection

- Transform existing applications with AI. Leverage AI to optimize operational processes, enhance customer experiences, and drive sustainable growth

A glimpse into the future

As the insurance industry continues to evolve, the integration of AI will play a crucial role in shaping its future. Companies must think strategically about how to leverage AI to enhance products, streamline operations, and deliver superior customer experiences. Technologists can facilitate the consumption of AI and enable guardrails to fit the company's governance and operating model.

By adopting a platform approach and embracing AI, insurance companies can achieve sustainable growth, operational efficiency, and competitive advantages. The key is to start small, experiment, and iterate, gradually building towards a future where AI is well-integrated into every aspect of the business.

Engage and innovate

If you're looking to integrate AI into your insurance business, then you can talk to a Red Hat expert and explore what AI can do for your company. Check the session recordings from Summit available online, and attend the next Red Hat event closest to you.

Stay tuned for more insights on the future of insurance and how Red Hat can help you navigate the digital transformation journey.

Relevant resources

- Watch the Keynotes

- Feature all the announcements at Red Hat Summit

1 Generative AI: A CEO innovation mandate for insurers (Deloitte US, access May 23, 2024)

2 Life Insurance Artificial Intelligence/Machine Learning Survey Results (NAIC Staff Report, 2023)

Sull'autore

Rafael Marins is a Senior Principal Product Marketing Manager at Red Hat, specializing in financial services. A technology executive passionate about open source innovation, leverages extensive experience in software development, entrepreneurship, and management. With an MBA from Pontificia Universidade Católica do Rio Grande do Sul and over 25 years in the industry, Rafael has significantly influenced strategic technology choices for insurers, banks, and capital markets.

Altri risultati simili a questo

Ricerca per canale

Automazione

Novità sull'automazione IT di tecnologie, team e ambienti

Intelligenza artificiale

Aggiornamenti sulle piattaforme che consentono alle aziende di eseguire carichi di lavoro IA ovunque

Hybrid cloud open source

Scopri come affrontare il futuro in modo più agile grazie al cloud ibrido

Sicurezza

Le ultime novità sulle nostre soluzioni per ridurre i rischi nelle tecnologie e negli ambienti

Edge computing

Aggiornamenti sulle piattaforme che semplificano l'operatività edge

Infrastruttura

Le ultime novità sulla piattaforma Linux aziendale leader a livello mondiale

Applicazioni

Approfondimenti sulle nostre soluzioni alle sfide applicative più difficili

Serie originali

Raccontiamo le interessanti storie di leader e creatori di tecnologie pensate per le aziende

Prodotti

- Red Hat Enterprise Linux

- Red Hat OpenShift

- Red Hat Ansible Automation Platform

- Servizi cloud

- Scopri tutti i prodotti

Strumenti

- Formazione e certificazioni

- Il mio account

- Supporto clienti

- Risorse per sviluppatori

- Trova un partner

- Red Hat Ecosystem Catalog

- Calcola il valore delle soluzioni Red Hat

- Documentazione

Prova, acquista, vendi

Comunica

- Contatta l'ufficio vendite

- Contatta l'assistenza clienti

- Contatta un esperto della formazione

- Social media

Informazioni su Red Hat

Red Hat è leader mondiale nella fornitura di soluzioni open source per le aziende, tra cui Linux, Kubernetes, container e soluzioni cloud. Le nostre soluzioni open source, rese sicure per un uso aziendale, consentono di operare su più piattaforme e ambienti, dal datacenter centrale all'edge della rete.

Seleziona la tua lingua

Red Hat legal and privacy links

- Informazioni su Red Hat

- Opportunità di lavoro

- Eventi

- Sedi

- Contattaci

- Blog di Red Hat

- Diversità, equità e inclusione

- Cool Stuff Store

- Red Hat Summit