The new normal in banking increasingly includes digital self-service, as customer expectations and demands have increased with the “consumerization” of banking on multiple devices.

Highly available digital products and services are dependent upon flexible distribution channels used to meet the banking needs of customers. Indeed, it requires more than an interactive interface.

Banking leaders surveyed in a Harvard Business Analytic Services report, sponsored by Red Hat, say they can't rely on more and more layers of customization to legacy core systems to provide the data and adaptability they now need.

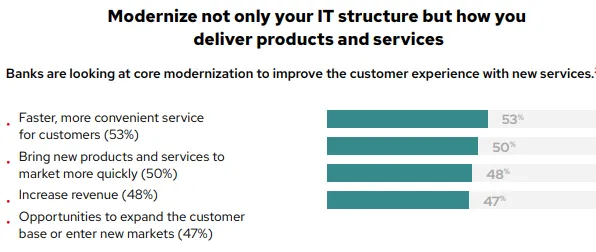

Eighty percent of those banking leaders surveyed responded that they plan to invest in core system modernization over the next year to provide faster, more convenient service for customers (53%) and bring new products and services to market more quickly (50%).

Often decades old, banking cores are becoming increasingly difficult and costly to maintain, and are approaching limits on incremental functionality enhancements. With more demands placed on the core for modern functions, like real-time transactions and personalized financial services, heritage systems are often struggling to keep up.

Often decades old, banking cores are becoming increasingly difficult and costly to maintain, and are approaching limits on incremental functionality enhancements. With more demands placed on the core for modern functions, like real-time transactions and personalized financial services, heritage systems are often struggling to keep up.

The path forward - weighing the risks and rewards

Banks must weigh the risk of changing core systems to improve the business against the need to drive the business forward, which includes reducing IT complexity and cost. A modernization strategy unique to the bank’s objectives that also considers the existing technology footprint can take different forms.

This includes extending existing mainframes to be cloud-enabled, renewing core systems with modern cloud-native solutions, or reinventing core systems altogether—perhaps even as a new brand. In any approach, it’s important to illustrate the ROI achieved in phases to help continue support for the ongoing journey – building upon incremental successes as a more progressive strategy to core system updates.

How are banks moving forward?

In the survey, 70% of respondents reported they are planning to purchase new systems from a core banking technology provider, while 39% plan to build new core systems in-house, an indication that a portion of banks are taking a hybrid approach.

When that is considered, along with 91% citing they are pursuing a platform based business model1 as a longer term objective, the steps taken in the early journey will impact the ease of executing strategy later on. The importance of flexibility, along with investment optimization to address immediate and near term needs - coupled with longer term strategic goals - brings the significance of the choice of foundational infrastructure technology for core banking modernization to the forefront.

Red Hat can help - independent of your stage in the transformation effort

Red Hat helps simplify core banking modernization with enterprise open source infrastructure that is engineered to access modern methodologies and transform at scale - in whatever step of your journey you may be in. With an open source approach that facilitates core banking modernization, banks can better manage innovations to the software stack.

This applies whether modernizing the mainframe to the cloud to accelerate time to market - including containerized cloud native integration bridging renewed systems with heritage systems - or as a cloud-native microservices architecture for containerized core business services. Red Hat OpenShift and cloud-native tooling can help banks adapt to the volatility of digital demands by supporting data insights for personalization, offering a consistent cloud experience that considers data sovereignty requirements, and helping extend the versatility of infrastructure support teams by providing the opportunity to expand skillsets.

With Red Hat and our core banking system partners, your modernization can be more portable, to address current and future needs.

We invite you to read the entire HBR Analytic Services survey, Modernizing Core Systems Has Become a Business Imperative for the Banking Industry, or explore Red Hat’s financial services solutions for more perspectives.

Sobre el autor

Described as a pioneer and one of the most influential people by CRMPower, Fiona McNeill has worked alongside some of the largest global organizations, helping them derive tangible benefit from the strategic application of technology to real-world business scenarios.

During her 25 year professional tenure, she has led teams, product strategy, marketing, and consulted across a wide range of industries, while at SAS, IBM Global Services, and others. McNeill co-authored Heuristics in Analytics with Dr. Carlos Andre Pinheiro, has previously published both in academic and business journals, and has served on the board of the Cognitive Computing Consortium. She received her M.A. in Quantitative Behavioral Geography from McMaster University and graduated with a B.Sc. in Bio-Physical Systems, University of Toronto.

Navegar por canal

Automatización

Las últimas novedades en la automatización de la TI para los equipos, la tecnología y los entornos

Inteligencia artificial

Descubra las actualizaciones en las plataformas que permiten a los clientes ejecutar cargas de trabajo de inteligecia artificial en cualquier lugar

Nube híbrida abierta

Vea como construimos un futuro flexible con la nube híbrida

Seguridad

Vea las últimas novedades sobre cómo reducimos los riesgos en entornos y tecnologías

Edge computing

Conozca las actualizaciones en las plataformas que simplifican las operaciones en el edge

Infraestructura

Vea las últimas novedades sobre la plataforma Linux empresarial líder en el mundo

Aplicaciones

Conozca nuestras soluciones para abordar los desafíos más complejos de las aplicaciones

Programas originales

Vea historias divertidas de creadores y líderes en tecnología empresarial

Productos

- Red Hat Enterprise Linux

- Red Hat OpenShift

- Red Hat Ansible Automation Platform

- Servicios de nube

- Ver todos los productos

Herramientas

- Training y Certificación

- Mi cuenta

- Soporte al cliente

- Recursos para desarrolladores

- Busque un partner

- Red Hat Ecosystem Catalog

- Calculador de valor Red Hat

- Documentación

Realice pruebas, compras y ventas

Comunicarse

- Comuníquese con la oficina de ventas

- Comuníquese con el servicio al cliente

- Comuníquese con Red Hat Training

- Redes sociales

Acerca de Red Hat

Somos el proveedor líder a nivel mundial de soluciones empresariales de código abierto, incluyendo Linux, cloud, contenedores y Kubernetes. Ofrecemos soluciones reforzadas, las cuales permiten que las empresas trabajen en distintas plataformas y entornos con facilidad, desde el centro de datos principal hasta el extremo de la red.

Seleccionar idioma

Red Hat legal and privacy links

- Acerca de Red Hat

- Oportunidades de empleo

- Eventos

- Sedes

- Póngase en contacto con Red Hat

- Blog de Red Hat

- Diversidad, igualdad e inclusión

- Cool Stuff Store

- Red Hat Summit